How to Choose a Forex Broker in Bolivia

Understanding Your Needs

Understanding your specific trading needs is the pivotal first step toward selecting an appropriate Forex broker in Bolivia. The first aspect to consider is your level of experience. Are you a novice embarking on your trading journey, or do you have a wealth of experience with Forex trading? This distinction is crucial as it influences your requirements, in terms of tools and support systems, that a broker must provide.

Consider the type of trading in which you will engage. Options include scalping, day trading, or long-term investing, each requiring different strategies and tools. Scalping demands rapid executions and low spreads due to its nature of frequent transaction volumes. In contrast, long-term investing may focus more on broader market trends and less on minute price fluctuations. These choices will determine the level of sophistication needed in your trading platform and the kind of analytical tools required. A comprehensive understanding of your needs will thus guide you in selecting a broker that best complements your trading style and financial goals.

Regulatory Compliance

Regulation stands as a cornerstone in the evaluation process of choosing a Forex broker, particularly when the local regulation landscape is sparse or evolving. In Bolivia, local regulatory frameworks for Forex trading might not be as stringent or developed. Therefore, opting for a broker that falls under the jurisdiction of reputable international regulatory bodies can provide an additional layer of security and reliability. Noteworthy regulatory bodies include the Financial Conduct Authority (FCA) in the United Kingdom and the Australian Securities and Investments Commission (ASIC).

These entities set rigorous standards aimed at ensuring operational transparency and safeguarding trader’s funds. Choosing a broker aligned with such regulations helps protect your investment against potential fraudulent activities and market manipulations. This ensures that the broker maintains the required standards of conduct, providing reassurance and stability for your trading activities.

Trading Platform and Tools

The trading platform serves as your direct access point to the Forex markets and is vital for executing trades efficiently and effectively. A user-friendly platform ensures that navigating complex charts and executing trades is seamless, reducing the potential for costly errors. Stability in a trading platform is crucial as it minimizes the risk of software crashes or connectivity issues which could interfere with trading operations.

Moreover, advanced trading platforms come equipped with a suite of technical analysis tools and charting capabilities. These features provide traders with valuable insights needed to make informed decisions. Automated trading options, such as expert advisors, can further enhance trading efficiency for those who wish to implement automated strategies. MetaTrader 4 and MetaTrader 5 are industry standards known for their reliability and comprehensive toolsets, making them popular choices for both novice and seasoned traders alike.

Costs and Fees

Being aware of the costs associated with trading is fundamental, as they directly impact net profitability. Brokers employ diverse fee structures, where spreads, commissions, and overnight fees are common components. Understanding these distinctions is crucial for evaluating the true cost of the services offered.

For instance, brokers may offer fixed or variable spreads. Fixed spreads remain constant, providing predictability, while variable spreads fluctuate based on market conditions, often offering lower rates in high liquidity situations. Ensuring transparency in pricing models enables traders to anticipate costs and make strategic decisions accordingly. A comprehensive analysis and understanding of these costs can safeguard traders from unexpected charges, allowing for more accurate financial planning.

Account Types and Leverage

Forex brokers frequently provide multiple account types tailored to different trading levels and investment capacities. It’s essential to consider which account type aligns best with your financial goals and risk tolerance. Factors to assess include minimum deposit requirements, available features, and trading conditions. Choosing the correct account type thus plays a pivotal role in optimizing your trading experience and achieving your financial aspirations.

An important aspect to consider is the offering of leverage. Leverage allows traders to control larger position sizes with a relatively small capital outlay, hence amplifying potential profits. However, it simultaneously increases exposure to the risk of losses. Therefore, judicious use of leverage is recommended, necessitating a well-defined risk management strategy to mitigate excessive financial exposure.

Customer Support

Reliable customer support is an integral component of seamless trading operations. A broker offering prompt and efficient support can swiftly address issues, minimizing disruptions to your trading activities. Assessing the availability of support services in your preferred language and during your specific trading hours enhances accessibility and convenience.

Customer support channels vary among brokers and typically include live chat, email, and telephone services. These multiple communication avenues allow for timely issue resolution and advice, thereby ensuring that traders can navigate challenges with informed guidance.

Research and Educational Resources

Educational resources and research tools are invaluable, catering to traders across all levels of expertise. Access to diverse educational materials, such as webinars, tutorials, and articles, enriches traders’ knowledge bases and hones their skills. An informed trader is more adept at interpreting market movements and making strategic decisions.

Furthermore, comprehensive market analysis and insights facilitate the development of sound trading strategies. Brokers that offer enhanced educational support equip traders with the necessary tools to navigate the complexities of the Forex market confidently.

Demo Account

Utilizing a demo account is a prudent approach before committing to a specific Forex broker. Demo accounts offer the opportunity to engage with the platform’s features and interface without the risk of financial loss. This risk-free environment is particularly beneficial in evaluating platform stability, execution speeds, and user-friendly experiences.

Additionally, demo accounts offer a practical avenue to trial various trading strategies and understand the flow of the Forex market, thus allowing potential users to gauge if the broker aligns with their expectations and necessities.

Conclusion

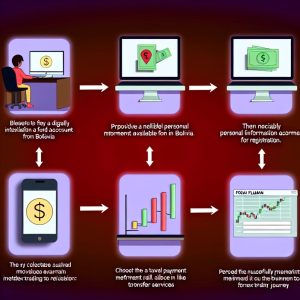

The process of selecting the right Forex broker in Bolivia necessitates thoughtful consideration of individual trading requirements, regulatory compliance, trading platform functionality, cost structures, and customer support quality. Engaging with these factors thoroughly enables a well-informed broker selection, ultimately facilitating alignment with trading strategies and maximizing the potential to achieve investment goals effectively.

This article was last updated on: April 14, 2025